Accounting: Cash Flow Statement vs. Funds Flow Statement

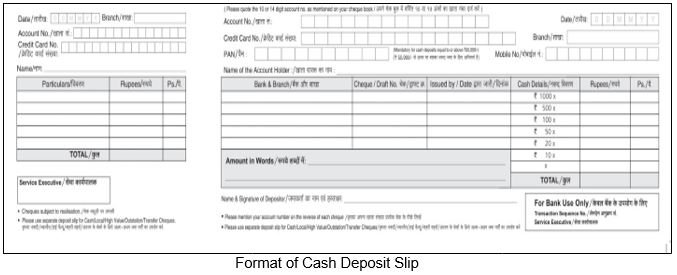

In financial accounting, understanding the movement of funds is essential for analyzing a company’s financial health. Two important tools for this purpose are the Cash Flow Statement and the Funds Flow Statement. While they may appear similar, they serve different purposes and provide unique insights. Let’s explore these statements in detail with examples. What is […]

Accounting: Cash Flow Statement vs. Funds Flow Statement Read More »