A cheque is a widely used payment method in both personal and business transactions. It serves as a written order directing a bank to pay a specific amount from the account of the issuer (drawer) to the person or entity named on the cheque (payee). Understanding how a cheque works and the various components written on it is essential for both individuals and businesses, especially when recording payments or receipts in financial accounting.

In this post, we will cover:

- The details found on a cheque.

- How to cross a cheque for security purposes.

- Examples to help businesses manage cheque transactions effectively.

1. Components Written on a Cheque

A standard cheque contains several important details. These details are critical for accurate accounting, as they help to identify the payer, payee, the payment amount, and ensure the correct processing of funds.

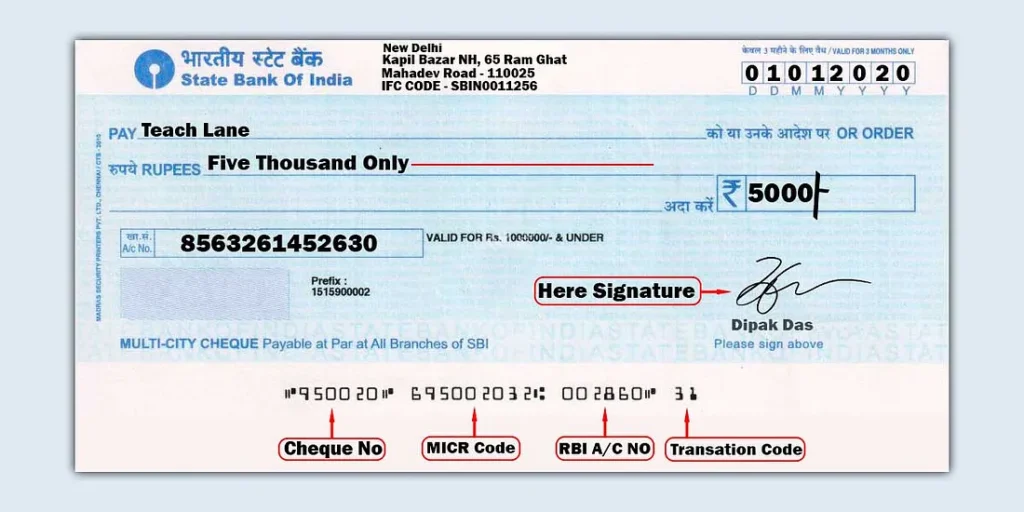

Here’s a breakdown of the key components written on a cheque:

1.1 Drawer’s Name and Account Number

- Drawer’s Name: This is the name of the person or business issuing the cheque. It appears at the top-left corner or sometimes along the top-right corner.

- Account Number: The drawer’s bank account number is printed near the bottom of the cheque. This ensures that the funds are withdrawn from the correct account.

1.2 Payee’s Name

- The payee is the person or organization to whom the cheque is being paid. The payee’s name is written in the line starting with “Pay to the order of” or simply “Pay.” It must be clearly stated to ensure the cheque is processed to the correct individual or business.

1.3 Cheque Amount (Numerical and Written)

- The cheque amount is written twice:

- Numerically: In digits, like ₹5,000.00.

- In Words: To avoid confusion or fraud, the same amount is written out in words, like “Five thousand rupees only.” This helps to prevent alterations.

1.4 Date

- The date when the cheque is issued is recorded. It ensures the cheque is valid and helps in accounting for transactions in the correct accounting period. Some cheques are post-dated, meaning the bank will only honor them on or after the specified date.

1.5 Signature

- The signature of the drawer is the final authority for the cheque. It must match the signature on file with the drawer’s bank.

1.6 Bank Details

- The bank’s name and branch are printed on the cheque, usually on the top-left or bottom-right corner.

- IFSC Code: In some countries, the IFSC (Indian Financial System Code) is also included to facilitate electronic payments.

1.7 Cheque Number

- Each cheque has a unique cheque number printed on it, which is useful for tracking the transaction and identifying the cheque in accounting records.

1.8 MICR Code (Magnetic Ink Character Recognition)

- This is a security feature, usually printed at the bottom of the cheque, that helps in quick processing and authenticity checks when the cheque is presented to the bank.

2. How to Cross a Cheque

Crossing a cheque is a common practice that adds an additional layer of security. A crossed cheque ensures that the payment can only be deposited into the bank account of the payee, preventing unauthorized individuals from cashing it. Here’s how you can cross a cheque:

2.1 What is Crossing a Cheque?

- Crossing a cheque involves drawing two parallel lines across the face of the cheque, either horizontally or diagonally, to restrict the payment to the payee’s bank account only. This ensures that the cheque cannot be cashed over the counter at a bank.

2.2 Types of Crossed Cheques

General Crossing:

- In a general crossing, two parallel lines are drawn across the face of the cheque, usually on the top-left or right side. No additional instructions are written.

- Purpose: This limits the payment to the payee’s account, meaning it can only be deposited into the account specified on the cheque. It cannot be cashed by the payee or any other person.

Example:

A business issues a cheque for ₹50,000 to a supplier. The cheque is crossed with two parallel lines, ensuring that the supplier must deposit the cheque into their own bank account.Special Crossing:

- In a special crossing, in addition to drawing two parallel lines, the name of a specific bank is written between the lines. This instructs the bank to deposit the cheque only into the account of the payee at the designated bank.

- Purpose: A special crossing is used when the drawer wants to ensure that the cheque is deposited at a particular bank, adding further security.

Example:

A business issues a cheque for ₹10,000 and crosses it with the name of the payee’s bank, “XYZ Bank.” This ensures that the payee’s bank is the only institution authorized to process the payment.

2.3 Not Negotiable Cheques

- A “Not Negotiable” cheque is similar to a crossed cheque, but the words “Not Negotiable” are written across the cheque. This ensures that the cheque cannot be transferred to another party.

3. Accounting for Cheque Transactions

When a business uses a cheque for payments or receives a cheque, it must be recorded in the financial accounting system to ensure accurate tracking of transactions. Here’s how you should account for cheques:

3.1 Issuing a Cheque (Payment)

Debit the relevant expense or liability account (e.g., Purchases, Salaries, Accounts Payable).

Credit the bank account (i.e., the account from which the cheque is issued).

Example:

A business issues a cheque to pay ₹25,000 for office supplies.- Debit Office Supplies Expense ₹25,000

- Credit Bank ₹25,000

3.2 Receiving a Cheque (Receipt)

When receiving a cheque, the amount is recorded as a credit to the revenue or accounts receivable account and a debit to the bank account once the cheque is deposited.

Example:

A business receives a cheque for ₹50,000 from a customer for outstanding payments.- Debit Bank ₹50,000

- Credit Accounts Receivable ₹50,000

3.3 Cheque Returns

If a cheque is returned due to insufficient funds or any other issue, the business needs to reverse the payment.

Example:

A business deposits a cheque, but it is returned due to insufficient funds. The business will reverse the earlier transaction by debiting Bank and crediting Accounts Receivable to restore the outstanding amount.

4. Example of a Crossed Cheque and Its Security Features

Let’s go through a simple example of a business issuing a crossed cheque:

A small business issues a cheque for ₹15,000 to a supplier for the delivery of goods. The cheque is crossed with two parallel lines to ensure that the cheque can only be deposited into the supplier’s bank account and cannot be cashed.

- Drawer’s Name: ABC Corporation

- Payee’s Name: XYZ Enterprises

- Amount (Numerically): ₹15,000.00

- Amount (In Words): Fifteen thousand rupees only

- Bank Details: HDFC Bank

- Crossing: Two parallel lines on the top-left of the cheque

In this case, the supplier must deposit the cheque into their own account, and it cannot be cashed at the bank counter, ensuring a higher level of security.

Conclusion: Why Understanding Cheques is Crucial in Financial Accounting

A cheque is not just a piece of paper—it is an important financial tool for businesses. Understanding what is written on a cheque, how to cross it, and how to account for cheque transactions ensures that your business’s finances are managed properly. By following proper accounting practices and safeguarding against fraudulent activities, businesses can maintain accurate records and secure financial transactions.

At Commands Global, we offer detailed training in Tally Financial Accounting, which includes managing cheque transactions, ensuring your business stays on top of its financial operations.

📘 Start Mastering Financial Accounting Today!

Visit www.commandsglobal.com to enroll in our comprehensive courses and enhance your accounting knowledge!