Cash Withdrawal Slip and Cash Deposit Slip: A Comprehensive Guide

In banking and financial accounting, cash withdrawal slips and cash deposit slips are essential documents used to facilitate transactions. These slips ensure accuracy, accountability, and proper record-keeping when handling cash.

This post will explain what these slips are, their components, and how to fill them out correctly, with detailed examples.

What is a Cash Withdrawal Slip?

A cash withdrawal slip is a document used by account holders to withdraw cash from their bank account. It serves as an authorization for the bank to disburse funds.

Components of a Cash Withdrawal Slip

- Account Holder’s Name: The name of the person withdrawing cash.

- Account Number: Unique identifier for the account from which cash is withdrawn.

- Date: The date of the transaction.

- Withdrawal Amount: The exact amount to be withdrawn.

- Signature: The account holder’s signature to authenticate the transaction.

- Bank Details: Name of the bank and branch.

How to Fill Out a Cash Withdrawal Slip

- Write your full name.

- Enter your account number accurately.

- Specify the date of the withdrawal.

- Mention the amount in words and numbers.

- Sign the slip where indicated.

- Submit the slip to the bank teller along with valid identification.

Example of a Cash Withdrawal Slip

Bank Name: XYZ Bank

Branch: Main Branch, Jaipur

| Field | Details |

|---|---|

| Name | Anjali Sharma |

| Account Number | 1234567890 |

| Date | 06/01/2025 |

| Amount (in words) | Twenty Thousand Only |

| Amount (in figures) | ₹20,000 |

| Signature | [Signature] |

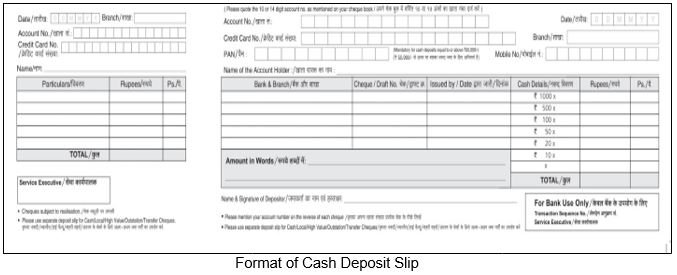

What is a Cash Deposit Slip?

A cash deposit slip is a form used by customers to deposit cash into their bank accounts. It provides the bank with a record of the deposit and ensures the correct amount is credited to the account.

Components of a Cash Deposit Slip

- Account Holder’s Name: The depositor’s name.

- Account Number: Where the deposit is credited.

- Date: Date of deposit.

- Deposit Amount: The total cash being deposited.

- Denomination Details: Breakdown of currency denominations (e.g., ₹500, ₹200).

- Signature: Depositor’s signature.

- Bank Details: Name of the bank and branch.

How to Fill Out a Cash Deposit Slip

- Enter your name and account number.

- Fill in the date of the deposit.

- Specify the total deposit amount in words and figures.

- Break down the denominations of the cash.

- Sign the slip to confirm the details.

- Submit the slip along with the cash to the bank teller.

Example of a Cash Deposit Slip

Bank Name: XYZ Bank

Branch: Main Branch, Jaipur

| Field | Details |

|---|---|

| Name | Rajesh Verma |

| Account Number | 9876543210 |

| Date | 06/01/2025 |

| Amount (in words) | Fifteen Thousand Only |

| Amount (in figures) | ₹15,000 |

| Denomination Breakdown | ₹500 x 20 = ₹10,000 | ₹200 x 25 = ₹5,000 |

| Signature | [Signature] |

Importance of Cash Withdrawal and Deposit Slips

- Accountability: Ensures all cash transactions are documented.

- Verification: Serves as proof of transaction for both the customer and the bank.

- Error Prevention: Reduces the chance of miscommunication or incorrect entries.

- Auditing: Assists in internal and external audits of financial records.

Tips for Using Cash Withdrawal and Deposit Slips

- Double-Check Details: Ensure names, account numbers, and amounts are accurate.

- Use Clear Handwriting: Write legibly to avoid errors.

- Keep Receipts: Retain a copy of the slip for future reference.

- Verify Denominations: Confirm the breakdown of cash when depositing.

Real-Life Example of Usage

Scenario 1: Cash Withdrawal

Sunita wants to withdraw ₹25,000 from her savings account. She visits the bank, fills out a cash withdrawal slip, and presents it to the teller. After verifying her identity, the teller disburses the cash and provides her with a stamped receipt.

Scenario 2: Cash Deposit

Ajay runs a small business and wants to deposit ₹50,000 in cash. He fills out a cash deposit slip, breaking the denominations as follows: ₹2,000 x 10, ₹500 x 40. After verification, the teller credits the amount to his account and provides him with a receipt.

Conclusion

Both cash withdrawal slips and cash deposit slips are simple yet essential tools for conducting cash transactions at banks. Understanding how to fill them accurately is crucial for smooth and error-free banking operations.

At Commands Global, our Financial Accounting courses include hands-on training on banking documents, ensuring you are well-prepared for real-world financial tasks.

📘 Enroll Today!

Visit www.commandsglobal.com to enhance your financial and accounting skills!

Heya i’m for the first time here. I came across this board

and I in finding It really helpful & it helped me out much.

I am hoping to offer something again and help others such as you helped me.